Healthcare, Insurance

Which Medical Conditions Qualify for Ill Health Retirement

Navigating the complexity of retirement planning can be difficult, especially when health issues come into play. For people with medical issues that limit their capacity to work, ill health retirement is a lifeline, providing financial support and security during a difficult time. However, identifying which medical disorders qualify for ill health retirement can be a complicated procedure that is influenced by a variety of factors such as the severity of the ailment, its impact on daily functioning, and the specific criteria established by pension schemes or insurance companies.

This article tries to clarify the qualifying criteria for ill health retirement by providing insights into the many medical problems that may qualify persons for this benefit. Individuals who understand the subtleties of the qualification process can confidently navigate their retirement alternatives, ensuring that they receive the help they require to preserve financial security while focusing on their health and well-being.

Eligibility Criteria for Ill Health Retirement

Define medical conditions

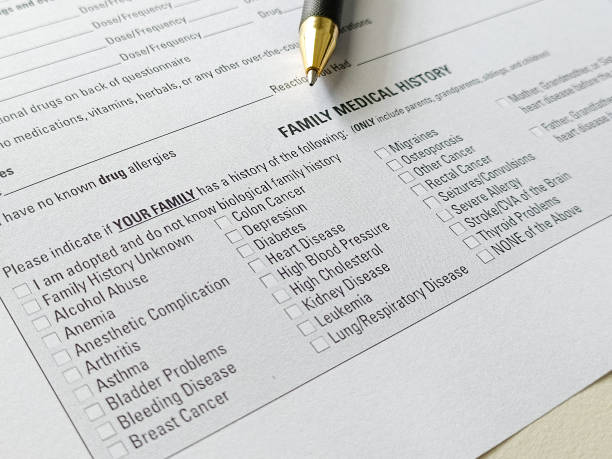

Ill health retirement is a pension plan that permits people to retire early owing to a medical condition that prevents them from working. The medical condition must be serious enough to preclude the individual from carrying out their job obligations and predicted to last at least one year. The following medical conditions may qualify:

- Chronic fatigue syndrome

- Cancer

- Depression, anxiety, and bipolar illness are all mental health problems.

- Multiple sclerosis and Parkinson’s disease are neurological illnesses.

- Musculoskeletal diseases, including back discomfort and arthritis.

- Asthma and COPD are respiratory illnesses.

- Cardiovascular problems include heart disease and stroke.

- Lupus and rheumatoid arthritis are autoimmune illnesses.

Assessment Process

To apply for ill health retirement, an individual must present medical documentation demonstrating that their medical condition is serious enough to preclude them from continuing to work. Medical records, test findings, and other medical proof might all be considered as medical evidence. The individual must also fill out an application form, which will be used to determine their eligibility for the pension program.

The eligibility criteria for ill health retirement may vary by pension plan, but in general, an individual must meet the following conditions:

- They must be under the pension plan’s prescribed pension age.

- They must have contributed to the pension for a minimum number of years.

- They must produce medical proof that their medical condition is serious enough to preclude them from continuing their work.

Finally, ill health retirement is a pension plan that permits people to retire early because they have a medical condition that prevents them from working. To be eligible for this plan, an individual must produce medical documentation that indicates their medical condition is serious enough to prevent them from continuing to work, and they must meet the qualifying conditions stipulated by their pension.

Understanding Ill Health Retirement Benefits

Ill health retirement allows an employee to retire early due to a medical issue. It is a benefit provided by many pension plans and can provide financial assistance to persons who are unable to work due to illness or disability. In this section of the article, we will look at the options accessible to persons considering ill-health retirement, as well as the financial ramifications of doing so.

Pension Scheme Options

The possibilities for ill-health retirement will vary depending on the pension scheme the individual is a member of. Some schemes may offer enhanced annuities, which provide a higher amount of income to people with medical issues. Others may provide a tax-free lump sum or the option of taking a reduced pension early.

It is crucial to note that the conditions for this kind of retirement vary in different pension schemes. For example, the eligibility requirements for ill health retirement benefits under the NHS Pension Scheme differ from the criteria used by the Department of Work and Pensions (DWP) to determine entitlement to Incapacity and Disability benefits.

Financial Implications

Taking ill-health retirement might have serious financial consequences. If a person is a member of a defined benefit scheme, their pension income may be cut if they retire early. If they meet the conditions, they may be eligible for an additional pension.

They may also be able to acquire an impaired life annuity, which offers a higher amount of retirement income to people with medical issues.

Before making a decision, thoroughly evaluate the financial ramifications of an ill-health retirement. It may be worthwhile to get guidance from a financial counselor or pension specialist to ensure that the individual makes the optimal selection for their specific situation.

Overall, ill-health retirement can provide significant financial assistance to persons who are unable to work owing to illness or disability. However, before making a decision, it is critical to grasp the various possibilities as well as the financial ramifications of retiring early.

The Application Process

Applying for ill-health retirement can be a complicated and time-consuming process. It entails obtaining the necessary documentation, filing an application, and potentially appealing any decisions made by the pension provider or plan administrator.

Gathering Required Documentation

To file for ill health retirement, the individual must present documentation of their medical condition and how it affects their capacity to work. This could include medical records from their doctor or medical adviser, as well as any pertinent test results or diagnostic imaging.

In addition to medical evidence, the individual may be required to present employment papers such as their contract, pay stubs, and any relevant policies or procedures.

Submission and Appeals

Once all necessary documentation has been acquired, the individual may submit their application for ill health retirement to their pension provider or plan administrator. The provider or administrator will then analyze the application and decide whether to grant the request.

If the application is denied, the individual may be able to appeal the decision. This usually entails submitting extra proof or documentation to support their position, which may necessitate the services of a legal practitioner.

It is crucial to remember that there may be time constraints for submitting an application for ill-health retirement or appealing a decision. Individuals should check with their employer or pension provider to determine the precise criteria and deadlines for their particular scheme.

Life After Ill Health Retirement

Financial Planning

After being medically retired due to an illness, it is critical to plan for the future. Seeking guidance from a financial consultant can help people understand their alternatives and develop a complete financial strategy. This may entail identifying sources of income such as employment and assistance allowance, universal credit, and the state pension. It is also critical to evaluate any workplace pensions and statutory sick pay that may exist.

Individuals who are unable to work owing to a medical condition may qualify for benefits such as personal independence payments and tax credits. A benefits calculator can help you determine your eligibility and estimate the amount of benefits you could get.

Planning for retirement age and earning potential is also necessary. Remortgaging, equity release, downsizing, and semi-retirement are all possibilities to explore. It is also critical to understand any redundancy benefits that may be offered.

Lifestyle Adjustments

Ill-health retirement can necessitate considerable lifestyle changes. It is critical to understand how the medical condition may affect daily life and adapt accordingly. Part-time work and discovering new hobbies or interests may be options to consider.

Individuals may also need to adapt their budgets to reflect changes in income. This can include lowering spending and finding new ways to save money. Getting guidance from a financial expert can help you develop a budget and find areas where you can save costs.

Overall, life after ill-health retirement can be difficult, but with adequate financial planning and lifestyle changes, people can build a secure and rewarding future.

Conclusion

To summarize, the qualifying criteria for ill health retirement cover a wide range of medical disorders, each assessed based on its influence on an individual’s capacity to work and retain financial independence.

While particular eligibility requirements may differ depending on the pension scheme or insurance provider, recognizing the vast range of ailments that may qualify individuals for this benefit is critical for effective retirement planning. Individuals can confidently navigate the qualification process by seeking guidance from healthcare professionals, financial advisors, and human resources experts, ensuring that they receive the support they require to transition into retirement while prioritizing their health and well-being.

Finally, this provides a critical safety net for those experiencing serious health issues, offering crucial financial aid during a time of uncertainty while allowing individuals to focus on their recovery and quality of life.

Trusted Health, Wellness, and Medical advice for your well-being